Take Control of Your Unsecured Debt

Powered by AI: Use Consumer Law to Fight Your Creditors!

Personalized Debt Resolution Plans

Comprehensive Credit Restoration

Debt Validation Program

Negotiation & Settlement Services

Legal Support & Financial Advisory

See if You Qualify in Less Than 30 Seconds!

Complete the form to get started.

Who's This Perfect For?

Anybody with substantial unsecured debt or any of the following:

Credit card debt

personal loan debt

repossessed auto loans

student loan debt

Medical debt

foreclosed mortages

Collections accounts

poor credit

summons & garnishment

Most individuals with poor credit or substantial unsecured debt can significantly benefit from these legal resolution programs!

Restore Your Credit & Settle Your Debts For Less Than What You Owe

How Do I Become Debt Free?

1. Free Financial Assessment

Objective: Begin with a free, no-obligation consultation to understand the client’s financial situation, goals, and specific needs.

Process: A dedicated financial expert reviews their credit report, identifies debts eligible for settlement or validation, and discusses the client’s options for reducing debt and boosting credit.

2. Customized Debt Resolution Strategy

Objective: Begin with a free, no-obligation consultation to understand the client’s financial situation, goals, and specific needs.

Process: A dedicated financial expert reviews their credit report, identifies debts eligible for settlement or validation, and discusses the client’s options for reducing debt and boosting credit.

3. Validation Using Consumer Law

Objective: Challenge the legitimacy of debt accounts, ensuring creditors can substantiate claims, often leading to debt reduction or elimination.

Process: Our legal team initiates the debt validation process by using consumer protection laws to question creditors' claims. Accounts that fail to meet validation requirements may be removed.

4. Negotiation & Settlement of Valid Debts

Objective: Negotiate settlements on validated debts, aiming to reduce balances, freeze interest, and establish manageable payment terms.

Process: For debts that pass validation, our negotiators work directly with creditors to reduce the amount owed. Through strategic negotiation, we often secure reduced lump-sum settlements or payment plans, halting further interest accrual and saving clients money.

4. Trust Account for Debt Payments

Objective: Manage client funds securely while maintaining transparency in all debt payments.

Process: All client funds are stored in an insured trust account, ensuring they’re safeguarded and tracked. This account is used to fulfill settlement agreements, making payments to creditors on behalf of the client as negotiated.

6. Simultaneous Credit Repair Process

Objective: Repair and improve credit scores in tandem with debt resolution to ensure comprehensive financial recovery.

Process: Our team uses advanced credit repair tactics to address inaccuracies on credit reports. As debts are validated, settled, or removed, these improvements reflect positively, helping clients see gradual increases in their credit scores.

7. Approvals with Partner Lenders & Consolidation

Objective: Open doors to future financial opportunities and funding for clients with improved credit.

Process: As credit scores improve and debts are resolved, clients become eligible for various loan offers. We work with trusted lending partners to connect clients to loan options tailored to their new financial standing, even paying off creditors for the settled amount, leaving you with just one reduced account in good standing.

Ready to get started?

TRY IT RISK FREE

100% Money Back Guarantee

All of your payments are securely placed in an FDIC-insured Trust Account under your name, providing full transparency and peace of mind. If you ever decide to cancel your enrollment, rest assured that every penny you've contributed to your Trust Account will be promptly returned to you. We’re committed to your financial success—and to giving you complete control over your journey.

NextStep Financial

Break free from debt and boost your credit with trusted solutions—start with a free consultation and see results within 18-36 months.

Why Choose Us?

Proven Expertise – Decades of experience in debt resolution and credit repair.

Legal Backing – Our dedicated legal team supports you every step of the way.

Transparent Process – Clear communication and real-time app tracking for full transparency.

Fast, Effective Results – Results within 12-24 months so you can start fresh sooner.

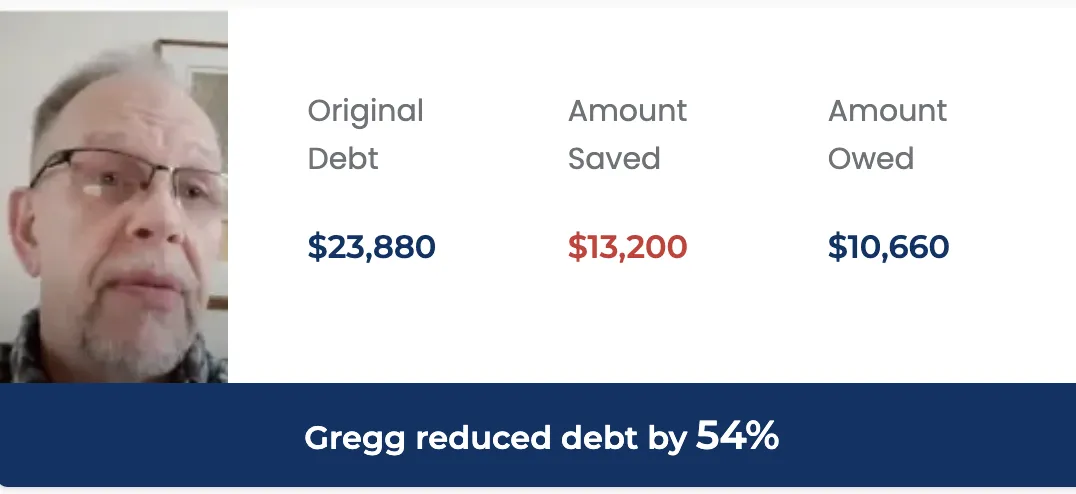

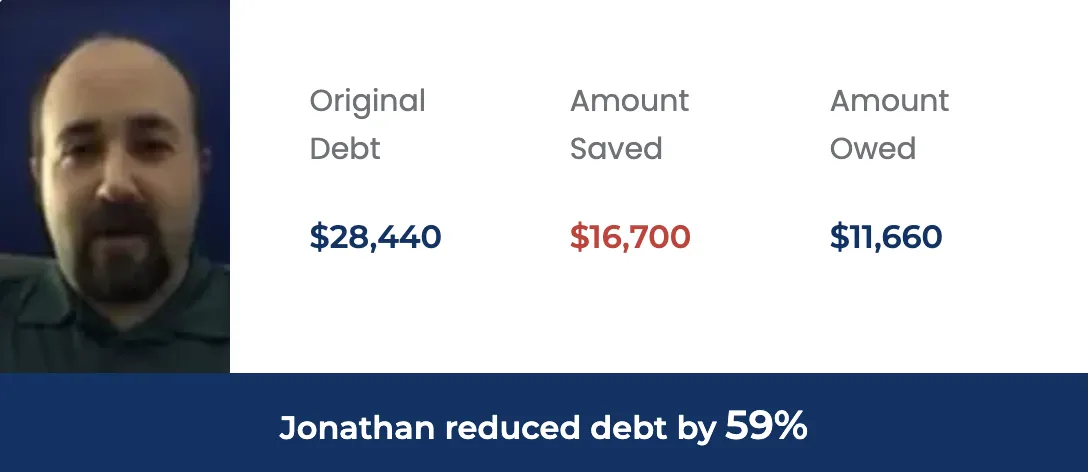

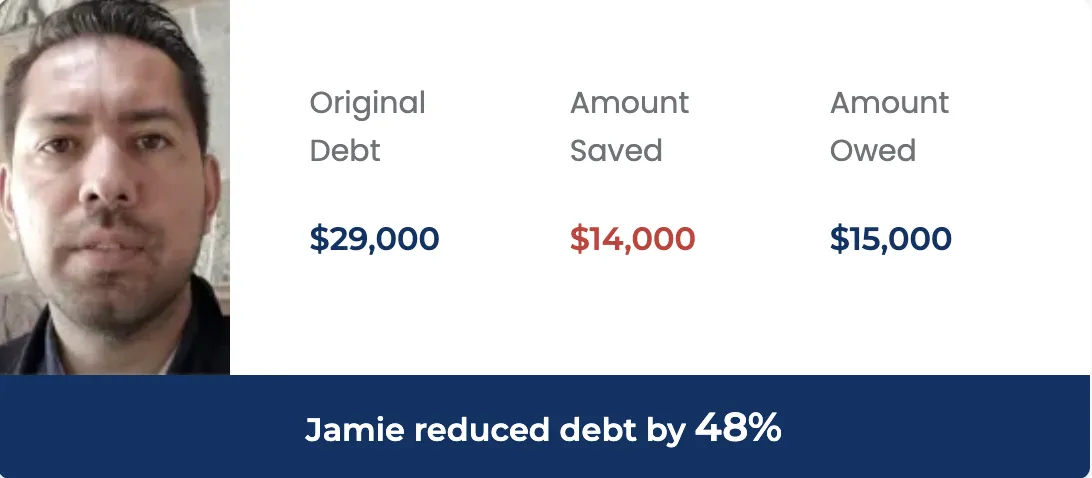

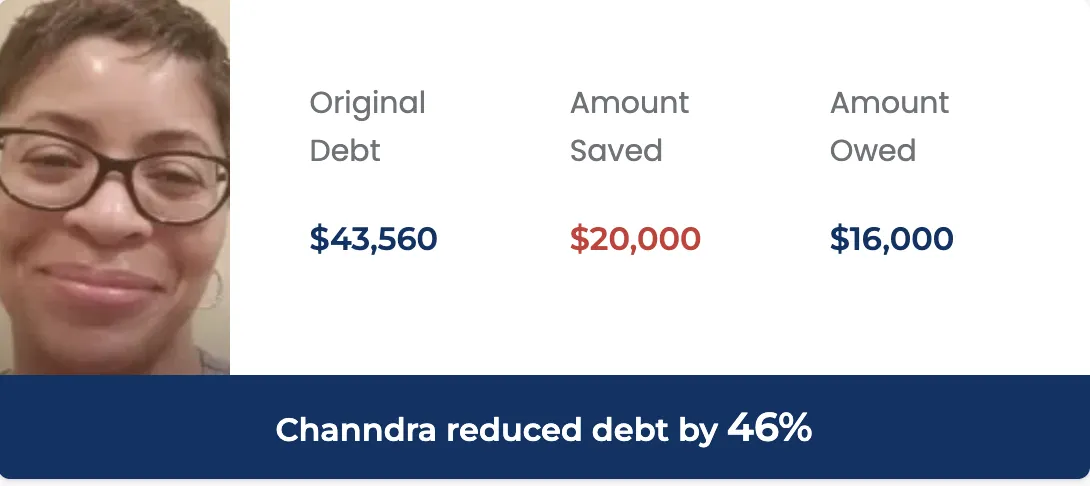

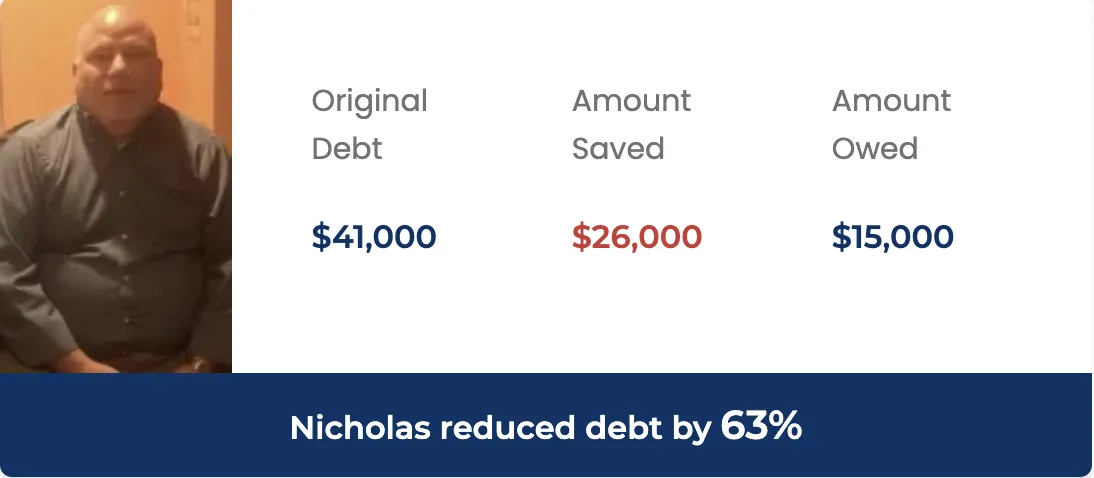

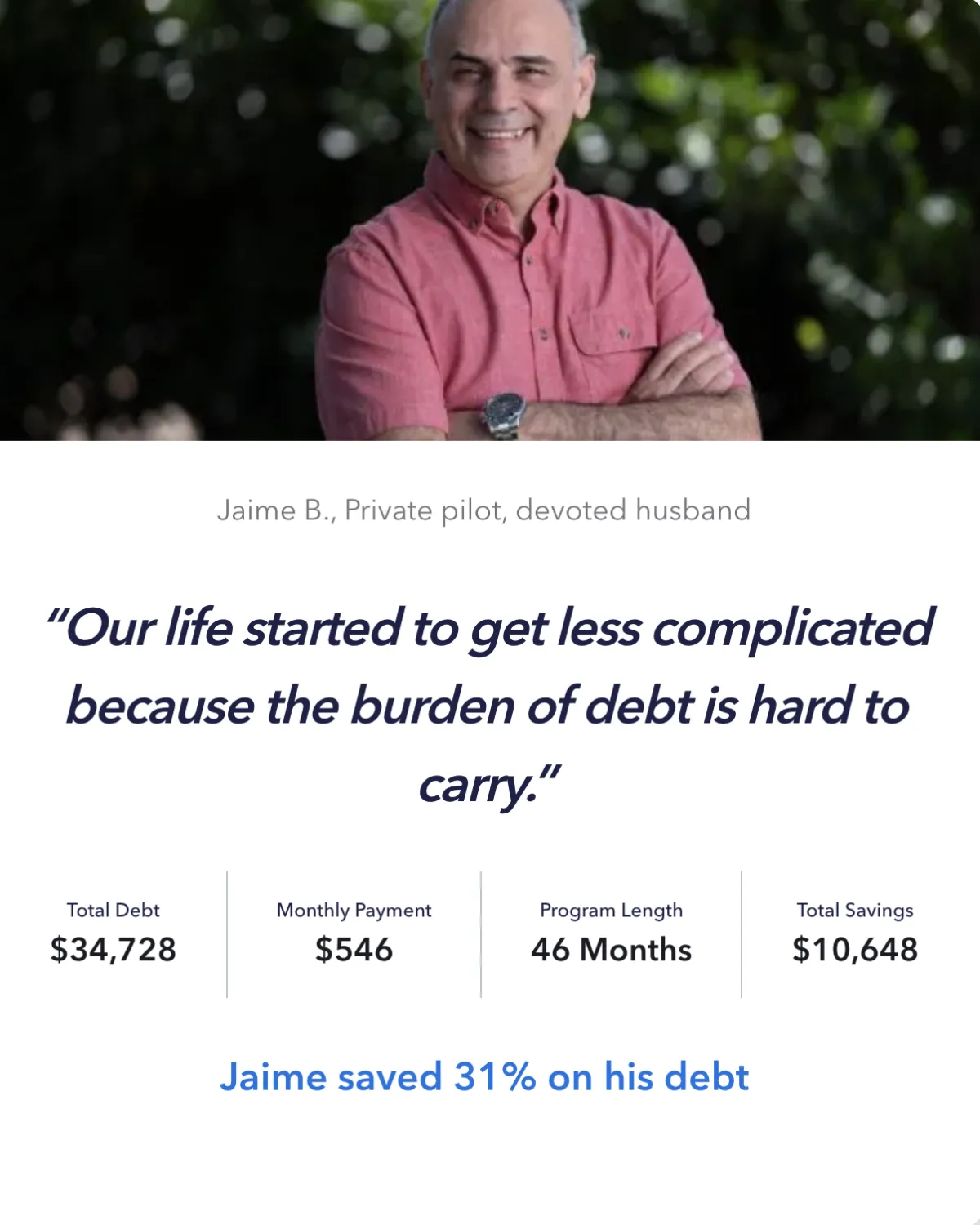

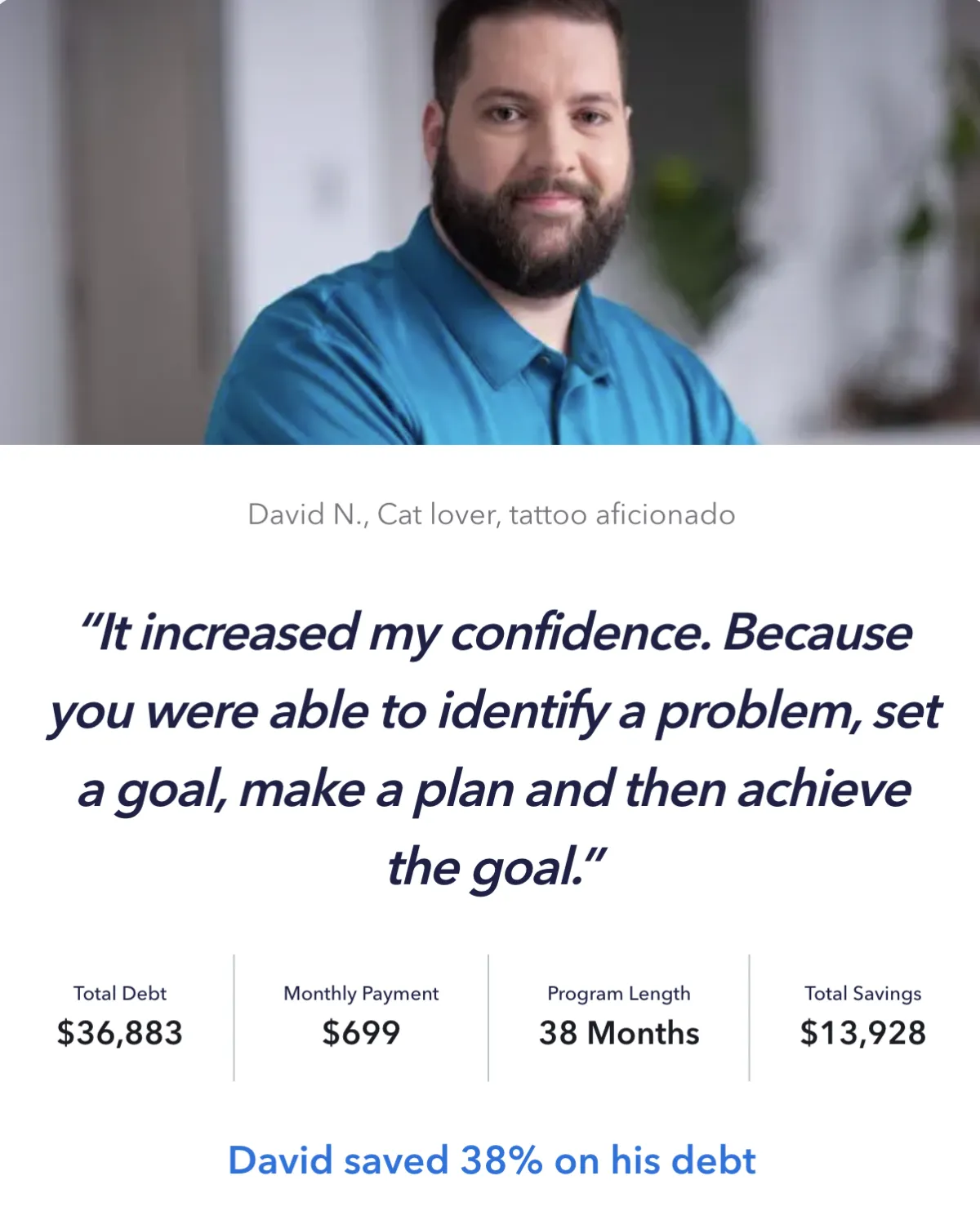

Success Stories

Consumers can save over 50% of their debt, while simultaneously perfecting their credit score!

Consumer Protection Laws We Leverage

Fair Credit Reporting Act (FCRA)

Objective: Ensures accuracy, fairness, and privacy in credit reporting. We leverage this law to challenge incorrect or unverifiable items on your credit report, helping to boost your credit score.

Fair Debt Collection Practices Act (FDCPA)

Objective: Protects against aggressive or unethical debt collection practices. We hold debt collectors accountable, reducing stress and empowering you against harassment.

Truth in Lending Act (TILA)

Objective: Safeguards against unfair or deceptive practices by creditors. We use this law to validate loan terms and challenge inaccurate interest rates, giving you peace of mind.

Ready to get started?

Comprehensive Services for Debt Freedom

Debt Validation & Disputes: We legally challenge and validate each debt to confirm its legitimacy, often resulting in debt reduction or removal.

Credit Repair & Dispute Resolution: We use advanced dispute methods to repair your credit, addressing any inaccurate or unverifiable items and helping you rebuild a strong financial profile.

Debt Negotiation & Settlement: Skilled negotiators work with creditors to secure reduced settlements, halt interest accumulation, and create manageable payment plans.

Trust Account Management: Client funds are held in a secure, insured trust account, ensuring that payments are made safely and transparently.

Quick Links

Home

Help Center

Book a Demo

Legal

NextStep Financial is a financial technology company that provides software, tools, and resources to assist consumers in managing debt and improving financial health. We are not a credit restoration company and do not provide direct credit repair services. Instead, we offer various debt resolution programs that may include debt validation, settlement options, and access to loan offers through third-party lenders. Results are not guaranteed, and individual outcomes may vary based on personal financial circumstances and adherence to program guidelines. NextStep Financial does not provide legal, tax, or financial advice, and our services should not be considered a substitute for professional counsel. For specific advice related to your financial situation, please consult with a licensed attorney, tax professional, or financial advisor.

Connect

© NextStep Financial 2024

All Rights Reserved